EnWave presenta los resultados financieros consolidados provisionales del segundo trimestre de 2023

Vancouver, B.C., May 26th, 2023

EnWave Corporation (TSX-V:ENW | FSE:E4U) (“EnWave”, or the “Company”) today reported the Company’s consolidated interim financial results for the second quarter ended March 31, 2023.

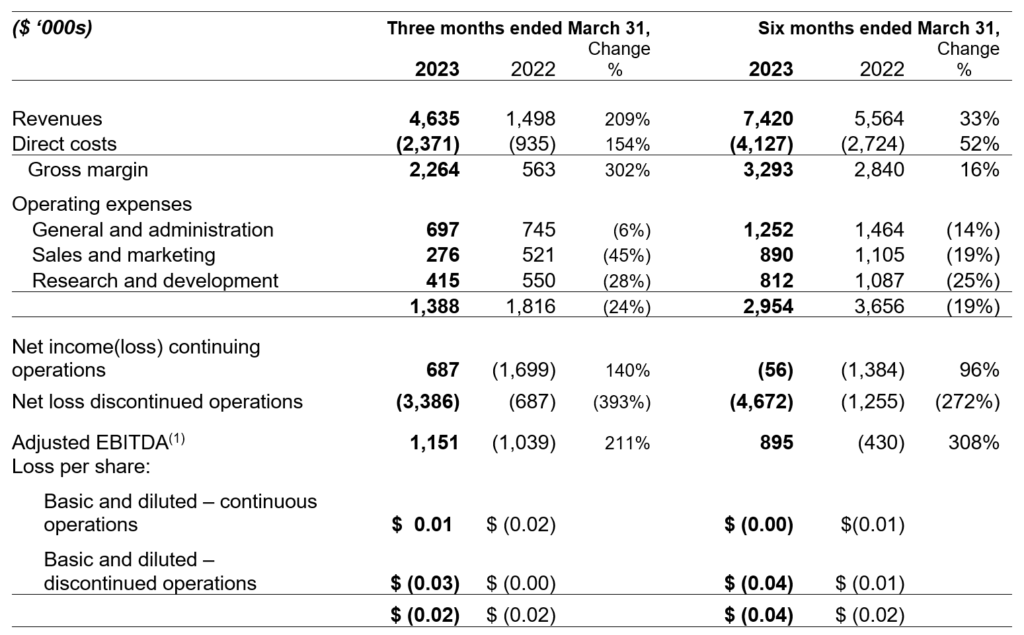

All values in thousands and denoted in CAD unless otherwise stated.

- Reported net income from continuing operations of $687 and Adjusted EBITDA(1) of $1,151 for Q2 2023, representing an increase of $2,386 and $2,190 respectively relative to the comparable period of the prior year. The increase was primarily due to the resale of two large scale machines and the wind down of NutraDried in Q2 2023.

- Completed the sale of NutraDried assets and a 100kW unit to Creations Foods U.S. incorporated for total consideration of $2,608 USD.

- Reported revenue for Q2 2023 of $4,635, representing an increase of $3,137 relative to the comparable period of the prior year.

- Commissioned two large scale 120kW units for the dehydration of fruit and vegetables in Italy and Thailand.

Consolidated Financial Performance:

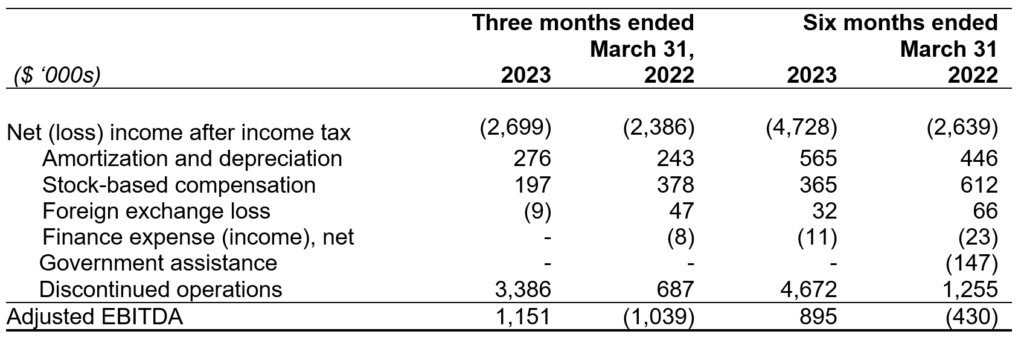

(1) Adjusted EBITDA is a non-IFRS financial measure. Refer to the Non-IFRS Financial Measures disclosure below for a reconciliation to the nearest IFRS equivalent.

EnWave’s annual consolidated financial statements and MD&A are available on SEDAR at www.sedar.com and on the Company’s website www.enwave.net

Key Financial Highlights for the Six Months Ended Q2 2023 (expressed in ‘000s):

- The Company reported revenue for the six months ended Q2 2023 of $7,420 compared to $5,564 for the six months ended Q2 2022, an increase of $1,856. The increase in revenue is primarily due to the resale of two large scale machines in the first half of 2023, relative to the comparable period of the prior year which had one machine resale.

- Royalty Revenues of $690 for the six months ended Q2 2023 compared to $750 for the six months ended Q2 2022, a decrease of $60. Some partners had higher base royalties during the calendar year, resulting in a smaller royalty obligation to meet the minimum annual royalty threshold. Additionally, some partners decided to forego exclusivity.

- Gross margin for the six months ended Q2 2023 was 44% compared to 51% for six months ended Q2 2022. EnWave sold two high margin machines in the quarter however, due to increased large-scale machines in fabrication, direct costs increased.

- SG&A expenses (including R&D) were $2,954 for the six months ended Q2 2023 compared to $3,656 for the six months ended Q2 2022, a decrease of $702. The decrease resulted from concerted efforts to reduce discretionary spending, including lower personnel costs in all departments.

- Adjusted EBITDA (refer to Non-IFRS Financial Measures section below) for the six months ended Q2 2023 was $895 compared to a loss of $430 for the six months ended Q2 2022, an increase of $1,325. The increase in adjusted EBITDA was primarily due to the wind down of NutraDried and its classification as discontinued operations, the resale of two large scale machines and the reduction of SG&A expenses (including R&D).

Significant Corporate Accomplishments in Q2 2023 and Subsequently:

- Commissioned a 120kW large-scale REV™ machine for Orto al Sole in Italy for production of premium dried fruits and vegetables for snacking.

- Commissioned a 120kW large-scale REV™ machine in Asia for Dole to start production of better-for-you snack products under the brand Good Crunch™ (https://www.dolefoodservice.com/good-crunch) using EnWave’s REV™ technology.

- Sold and commissioned a 120kW REV™ machine to a major Canadian cannabis company to produce premium smokeable flower, cannabis plant material for extraction and edible products.

- Sold two 10kW REV™ machines to a current royalty partner tripling its North American REVTM manufacturing capacity for production to support a growing market demand.

- Signed a license with PiP International Incorporated (“PIP”) to allow for the commercialization of high-value plant-based ingredients. Additionally, PIP purchased a 10kW REV™ machine for continued product development.

Medidas financieras distintas de las NIIF:

This news release refers to Adjusted EBITDA which is a non-IFRS financial measure. We define Adjusted EBITDA as earnings before deducting amortization and depreciation, stock-based compensation, foreign exchange gain or loss, finance expense or income, income tax expense or recovery and non-recurring impairment, restructuring and severance charges, government assistance and discontinued operations. This measure is not necessarily comparable to similarly titled measures used by other companies and should not be construed as an alternative to net income or cash flow from operating activities as determined in accordance with IFRS. Please refer to the reconciliation between Adjusted EBITDA and the most comparable IFRS financial measure reported in the Company’s consolidated financial statements.

Non-IFRS financial measures should be considered together with other data prepared accordance with IFRS to enable investors to evaluate the Company’s operating results, underlying performance and prospects in a manner similar to EnWave’s management. Accordingly, these non-IFRS financial measures are intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. For more information, please refer to the Non-IFRS Financial Measures section in the Company’s MD&A available on www.sedar.com.

Acerca de EnWave

EnWave is a global leader in the innovation and application of vacuum microwave dehydration. From its headquarters in Delta, BC, EnWave has developed a robust intellectual property portfolio, perfected its Radiant Energy Vacuum (REV™) technology, and transformed an innovative idea into a proven, consistent, and scalable drying solution for the food, pharmaceutical and cannabis industries that vastly outperforms traditional drying methods in efficiency, capacity, product, quality, and cost.

With more than fifty royalty-generating partners spanning twenty six countries and five continents, EnWave’s licensed partners are creating profitable, never-before-seen snacks and ingredients, improving the quality and consistency of their existing offerings, running leaner and getting to market faster with the company’s patented technology, licensed machinery, and expert guidance.

La estrategia de EnWave consiste en firmar licencias comerciales con derechos de autor con productores de alimentos y cannabis que deseen secar mejor, más rápido y de forma más económica que la liofilización, el secado en bastidor y el secado al aire, y disfrutar de las siguientes ventajas:

Corporación EnWave

Sr. Brent Charleton, CFA

Presidente y CEO

Para más información:

Brent Charleton, CFA, Presidente y Director General, +1 (778) 378-9616

Correo electrónico: bcharleton@enwave.net

Dylan Murray, Director Financiero, +1 (778) 870-0729

Correo electrónico: dmurray@enwave.net

Safe Harbour para declaraciones de información prospectiva: Este comunicado de prensa puede contener información prospectiva basada en las expectativas, estimaciones y proyecciones de la dirección. Todas las declaraciones que se refieran a expectativas o previsiones de futuro, incluidas las declaraciones sobre la estrategia de crecimiento de la empresa, el desarrollo de productos, la posición en el mercado, los gastos previstos, el cese de las inversiones de la empresa en NutraDried, el calendario de liquidación y disolución de NutraDried, las expectativas sobre el coste de liquidación de NutraDried y el enfoque previsto por la empresa para el futuro, son declaraciones prospectivas. Estas afirmaciones no garantizan resultados futuros e implican una serie de riesgos, incertidumbres y suposiciones. Aunque la empresa ha intentado identificar los factores importantes que podrían hacer que los resultados reales difirieran materialmente, puede haber otros factores que hagan que los resultados no sean los previstos, estimados o intencionados, incluyendo que el proceso de liquidación de NutraDried implique para la empresa un tiempo y unos gastos materialmente mayores de lo previsto, que la realización de los activos de NutraDried no cubra suficientemente la liquidación ordenada de NutraDried, lo que podría dar lugar a la necesidad de financiación adicional por parte de la empresa para completar dicha liquidación, que los acontecimientos anteriores afecten negativamente a la empresa, en términos de coste, tiempo de gestión y enfoque, perspectivas o reputación; la capacidad de la empresa para alcanzar sus perspectivas a largo plazo, la capacidad para reducir costes y los demás factores de riesgo expuestos en los documentos públicos de la empresa. No puede garantizarse la exactitud de tales afirmaciones, ya que los resultados reales y los acontecimientos futuros podrían diferir sustancialmente de los previstos en dichas afirmaciones. Por consiguiente, los lectores no deben depositar una confianza indebida en las declaraciones prospectivas.

Ni la TSX Venture Exchange ni su Proveedor de Servicios de Regulación (según se define este término en las políticas de la TSX Venture Exchange) aceptan responsabilidad alguna por la adecuación o exactitud de este comunicado.